Pacific Gas & Electric Company has been called a "terror" to the people of California. Its electric grid has sparked wildfires each of the last four years and is suspected of igniting this year's Dixie Fire, the second-largest blaze in the state's history.

The company is mired in debt. Electricity rates are skyrocketing. Tens of thousands of survivors of fires sparked by the utility's equipment are waiting for promised compensation.

Amid all this pain, there's one group that's simply walking away: Wall Street hedge funds.

A KQED/California Newsroom analysis of documents on file with the U.S. Securities and Exchange Commission, or SEC, found that 20 Wall Street hedge funds have collectively dumped 250 million PG&E shares — two-thirds of their collective holdings in the company — since PG&E emerged from bankruptcy protection last year. Those hedge funds grossed at least $2 billion dumping the stock, our analysis found. At least seven funds have sold off their entire PG&E stake.

What's more: Many of these same hedge funds got an extraordinary amount of PG&E stock without paying a cent for it.

That gigantic stock giveaway, which handed $1.5 billion worth of PG&E stock to the hedge funds, is widely acknowledged to be the largest of its kind in the history of corporate bankruptcy. Under the agreement, known as an equity backstop, PG&E gave the hedge funds 169 million shares in the company in exchange for a guarantee the hedge funds would buy more stock if no one else stepped forward as the company prepared to leave bankruptcy.

That didn't happen, but the hedge funds nevertheless collected their payout.

In an interview, Nora Mead Brownell, PG&E's board chair during most of its recent bankruptcy, described the deal as a cost of doing business in a high-risk, politically charged environment. Without the guarantee from the hedge funds, the company could not have left bankruptcy by the deadline mandated by Gov. Gavin Newsom, she said.

"Everybody can hate hedge funds," she said but "the hedge funds were the people who were there.”

That they ended up not having to buy more stock was immaterial, she added: "Hedge funds get paid for taking risk, and that's what they got paid for."

But the current hedge fund sell-off of PG&E shares has direct consequences for approximately 70,000 fire survivors who lost loved ones, homes and businesses to blazes sparked by PG&E's equipment between 2015 and 2018.

Thanks to a legal settlement engineered by these same hedge funds during the bankruptcy, these fire survivors now hold nearly 500 million shares representing nearly a quarter of the company's stock through a special trust.

But with the hedge fund stock dump putting downward pressure on PG&E's share price, fire survivors — whose Fire Victim Trust has held onto its shares — face a return dramatically lower than what they were promised by both PG&E and their own lawyers. The value of the fire survivors' stock has never achieved the $6.75 billion figure survivors were promised and so, while hedge funds are moving on, fire survivors have been left holding the bag.

"It's nothing but a con, isn't it? How can they do that?" said Terry McBride, 61, who lost her Calaveras County home in a fire that PG&E caused in 2015. Since then, she's shared a trailer with her 25-year-old daughter. They live on the same lot where their home burned down.

"How can they look in the mirror and put together an agreement like that?" McBride said. "What part of humanity do they belong to? It's not the humanity I belong to where I actually care about my brothers and sisters and my fellow citizens."

KQED and The California Newsroom reached out to eight of the hedge funds dumping stock. None would comment on the record for this story.

Fire survivors, UC Hastings College of the Law professor Jared Ellias noted, "are not the bankruptcy experts that the hedge funds were" and so the hedge funds "left the fire victims with the risk of the shares and the risk of the deal."

The hedge funds' maneuverings have had dire consequences not only for fire survivors, but also for PG&E's 16 million ratepayers, who spend about 80% more on power than the national average, according to a recent study. And PG&E wants to increase rates by an average of 19% going forward. Experts say that's in part because of all the debt the company took on while the hedge funds exerted control over the company — having replaced nearly the entire board of directors in early 2019 with new arrivals half of whom had investing or corporate restructuring backgrounds.

Though companies usually use the bankruptcy process to get on surer financial footing, PG&E's debt load has exploded from $22 billion before the bankruptcy to $38 billion when it ended in mid-2020. That debt has escalated further since it left Chapter 11 last year, rising to $42.5 billion.

"You have to pay debt back," said John Geesman, a former member of the California Energy Commission, who said the impacts will only become more extreme with time as the company attempts to repair its long-neglected system. PG&E's precarious financial state coming out of bankruptcy "impacts the ability of the company to finance necessary infrastructure improvements and necessary fire mitigation."

Geesman said the company's fragile financial state means it is more likely to spark wildfires and even enter another bankruptcy — an outcome, he said, engineered by the hedge funds but also hardly a surprise.

"It's a little bit like complaining when sharks bite people," Geesman said. "You have to ask yourself, why did we agree to this?"

Hedge funds dumping stock

The sell-offs run counter to the hedge funds' public pronouncements.

Last April, while fire survivors were voting on their settlement, the head of one large fund rejected the notion that there would be a stock dump that would depress the value of the victims' shares.

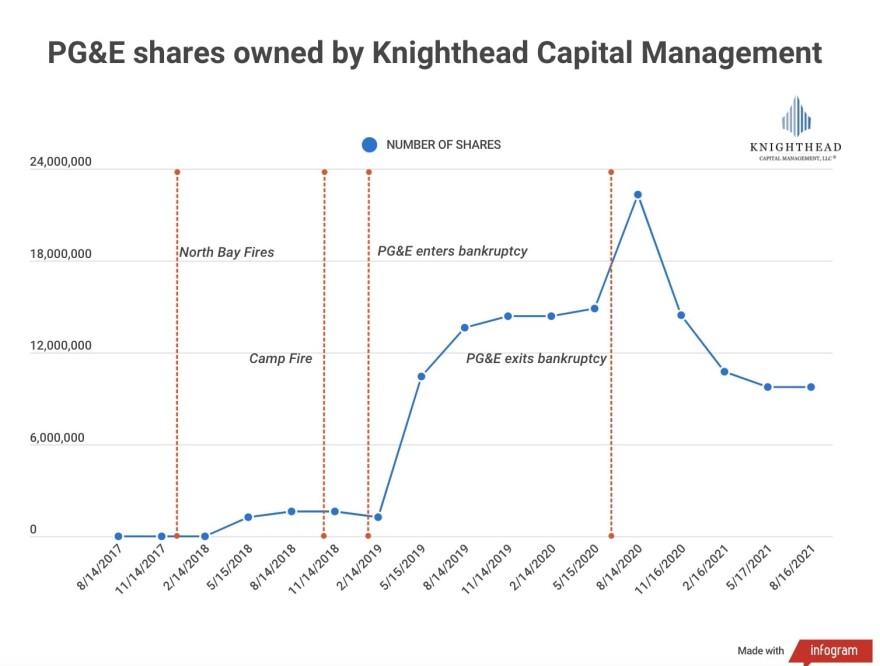

"The idea that everybody will suddenly turn around and sell all of their stock at the same time is inconsistent with how these investors approach the situation over a long period of time and certainly inconsistent with selling something at well below fair value," Tom Wagner, the head of Knighthead Capital Management, said in an April 2020 interview with Bloomberg TV.

The hedge funds dumping stock run the gamut from the relatively obscure to some of the most celebrated names on Wall Street. They include one founded by nonagenarian billionaire George Soros, and another started by famed Wall Street investor David Tepper, who was once profiled in a New York Magazine article titled "Ready to Be Rich" and whose name now graces the business school of his alma mater, Carnegie Mellon.

Reporting by KQED has shown that another fund, Centerbridge Partners, was part of a group of investors that bankrolled mass tort lawyer Mikal Watts with a massive line of credit. Watts had bragged about scoring a $13.5 billion settlement for fire survivors.

Critics say the line of credit represents a potential conflict of interest, since Centerbridge stood to benefit if fire survivors got a smaller settlement.

Indeed, the settlement has never been worth the $13.5 billion Watts claims. The December 2019 deal between PG&E and fire survivors was composed of $6.75 billion in cash and PG&E stock that was said to be worth an equal amount. But when PG&E funded the stock at the market price of about $9, the stock component ended up falling more than $2 billion short.

'The justice system thoroughly failed the survivors of these fires. They thoroughly failed us. That's a fact.'Terry McBride, fire victim

The stock has ticked up this month, reaching $10.70 on October 8 after lagging for much of the summer. But shares would have to top $14 for the settlement to be worth $13.5 billion.

The filings reviewed by KQED and The California Newsroom reflect stock holdings by these hedge funds through June 30. Two weeks after that date, the Dixie Fire erupted, burning down the historic town of Greenville on its path to destroying nearly a million acres and becoming the second largest fire in California history. PG&E has indicated that its equipment may have played a role in sparking the catastrophic blaze.

PG&E also now faces manslaughter charges in the 2020 Zogg Fire, which killed four people in Shasta County. It's the second time PG&E has faced manslaughter charges in as many years. Last year, the company pleaded guilty to 84 involuntary manslaughter counts stemming from the 2018 Camp Fire.

In a statement to KQED and The California Newsroom, PG&E said state regulators closely monitor the utility's "financial health" to ensure it "can continue to make important safety, reliability and clean energy improvements." The company said that it was moving forward with a plan to improve wildfire mitigation and the resilience of the grid.

But Mark Toney, executive director of The Utility Reform Network (TURN), said that while PG&E is improving when it comes to wildfire safety, the legacy of the hedge funds is clear: "The high debt makes it hard for the company to invest in infrastructure," Toney said.

A bet gone wrong

In conducting our analysis, KQED and The California Newsroom reviewed hundreds of securities filings, known as 13Fs, which large institutional investors must submit to the U.S. Securities and Exchange Commission every three months. The documents offer a snapshot of a hedge fund's portfolio, showing how much stock it holds in various companies at the end of each quarter.

The filings tell the story: Hedge funds saw an opportunity to profit by buying low when PG&E's stock price plunged after a series of fires tore through the North Bay in 2017. The firestorm killed 44 people and destroyed thousands of homes. PG&E shares fell from $70 to $45 within weeks.

But PG&E's share price had much further to fall. The following year, the 2018 Camp Fire sent shares plummeting to $25 in the days after PG&E equipment sparked the blaze before plummeting to $7 when PG&E chose to enter Chapter 11 a few weeks later. The fire killed 85 people and displaced tens of thousands in and around the town of Paradise. It remains the deadliest and most destructive fire in California history.

As shares sank, many hedge funds that had scooped up shares after the 2017 fires watched their big bet on PG&E turn sour.

"How can they look in the mirror and put together an agreement like that? ... What part of humanity do they belong to? It's not the humanity I belong to where I actually care about my brothers and sisters and my fellow citizens."Terry McBride, fire victim

At that point, some of the funds decided to dramatically increase their purchases of PG&E shares, filings show. Knighthead joined forces with two other funds — Abrams Capital Management and Redwood Capital Management. This trio emerged as leaders of a group of hedge funds that would go on to exert control of the bankruptcy of PG&E, using its leverage to remake PG&E's board on the heels of the company's decision to enter Chapter 11. Wagner would serve as the public face of the group.

By the time the bankruptcy was finalized last summer, Wagner's fund held 22.3 million shares of PG&E, at least a quarter of which had been received at no cost as part of the backstop, valued at almost $200 million, according to its 13F filings.

But though Wagner dismissed the idea that investors would quickly dump their stock on Bloomberg TV, Knighthead has since sold off more than half its PG&E shares, our analysis of filings shows.

Another hedge fund, Anchorage Capital Group, held as many as 45 million shares worth $425 million last year. 13F filings show Anchorage had sold off its entire stake by this past March. Anchorage also participated in the backstop and received an estimated 8 million shares, worth at least $68 million, in the giveaway

GoldenTree Asset Management, Stonehill Capital Management and the SteelMill Master Fund are among the slew of other hedge funds who have completely exited the stock. Before the bankruptcy ended, each of these funds held more than $100 million worth of PG&E shares.

But these sales pale in comparison to the sell-off by David Tepper's Appaloosa Management. Tepper has long kept tabs on PG&E.

"Of course California will bail out Pacific Gas & Electric Company, because it's not going to let the state not have power," reporter Jessica Pressler wrote of Tepper's philosophy in her 2010 New York Magazine article "Ready to Be Rich." Tepper is invested in being "a regular guy," she wrote. Appaloosa was also part of a foursome of private investors that purchased PG&E shares at a discount as the company raised money in preparation to leave bankruptcy protection.

Filings show that Appaloosa owned nearly 81 million shares of PG&E worth $760 million as of last September. An estimated 10 million shares, worth at least $82 million, likely were provided by the backstop. By June, however, Appaloosa had slashed its stake in PG&E by around 80%.

Appaloosa did not respond to our inquiries about its decision to sell off while fire survivors struggled.

Meanwhile, Centerbridge Partners, the hedge fund that helped bankroll attorney Mikal Watts, sold 1.8 million shares - a fifth of its stake - in the year after PG&E’s left Chapter 11 bankruptcy. KQED and The California Newsroom estimate that Centerbridge was given around 3.5 million shares, worth at least $29 million, at no cost through the special backstop arrangement.

Centerbridge was co-founded by Mark Gallogly, who was appointed as an adviser to President Joe Biden's climate team earlier this year. Gallogly's appointment immediately drew rebukes from environmental advocacy groups, who said he had profited from climate emergencies in both California and Puerto Rico. Gallogly departed Biden's climate team a few months later.

Not every hedge fund with significant PG&E holdings has dumped the stock. Baupost owned about 30 million shares of PG&E as of June. The fund got most of that, around 21 million shares worth at least $174 million, at no cost in the equity backstop deal. That's more than any other hedge fund.

In a statement, a Baupost spokesperson said it participated in the backstop after being asked by several parties in the bankruptcy — including representatives of fire survivors — to "support the company's emergence from bankruptcy."

Baupost salvaged a badly timed investment in PG&E stock by buying PG&E insurance claims for cheap. In the bankruptcy, this insurance group shared $11 billion in cash, far more than fire survivors.

The great risk shift

Through it all, the special trust for PG&E's 70,000 fire survivors continues to hold onto stock in the company that sparked fires that destroyed their homes or killed their loved ones.

Many fire survivors want to be rid of the emotional burden that comes with this, and receive cash that would come with the stock's sale, but the stock has continued to lag well below the level needed to make fire victims whole. In June, John Trotter, the court-appointed trustee of the Fire Victim Trust, signaled in a YouTube video that he planned to hold off on selling any of the 478 million shares it owns.

"The story of the stock is not a good one," Trotter said in the video, without indicating a timeline of when he might sell the shares. Fire survivors "should want PG&E to do well," he added.

"It's such quicksand," Trotter told KQED and the California Newsroom in a subsequent interview. Trotter said he expects that there may only be enough to provide survivors 60% of what they are owed. They will "never be made whole," Trotter said.

As Terry McBride and her daughter wait for compensation from the Fire Victim Trust, they've had to brave a combination of extreme heat and wildfire smoke that leaves them with persistent headaches. The temperature in their trailer regularly spikes higher than 100 degrees. They've covered their trailer, which Terry refers to as "a tin can," with reflective paint to try to lower the temperature inside by a few degrees on the hottest days.

They live modestly while they wait. Terry spends much of her time gardening while her daughter spends hours doing crafts each day. Terry says she has grown increasingly dependent on her daughter as her eyes start to fail her.

"I have zero doubt that Wall Street was behind this. We're not of value to them. We have no value to them," McBride said. "The justice system thoroughly failed the survivors of these fires. They thoroughly failed us. That's a fact."

McBride is among the vast majority of fire survivors who have yet to receive any money from the Fire Victim Trust.

Wall Street analysts have taken notice that fire survivors appear stuck with the stock, because that means a quarter of PG&E's stock remains off the market, providing stability to the stock price.

In June, when Trotter indicated his willingness to wait on selling the stock, analyst Julien Dumoulin-Smith of Bank of America called the announcement a "de-risking factor," or a reassuring sign for investors in the face of the company's other risks — such as the fact that the company continues to be linked to new wildfires.

"Critically trustee Justice John Trotter indicated in recent days that no imminent sales are planned as the Trust continues to work through issues of taxable gains on any share sales," he wrote in a research note this summer. "We see this as potentially serving as [an] offsetting de-risking factor against otherwise elevated near-term fire risks."

Another analyst, Jonathan Arnold of Vertical Research Partners, referred to the trustee's comments as "the glass-half-full headline takeaway for the market."

'Who is responsible for this?'

Some fire survivors say they are caught in the middle of a Wall Street game that they never wanted to play. Their settlement has shifted PG&E's myriad risks onto them.

Regardless of what happens to the stock now, Camp Fire survivor Tony Dunn wants to understand why PG&E was permitted to fund an amount of stock that ended up being worth $4.5 billion — not the promised $6.75 billion.

"It looks like they cut themselves a 33% discount. Where's the oversight on this to say, 'You can't do that'?" Dunn told KQED by phone from his home near Asheville, North Carolina, where he and his wife, Jhan, moved about a year after they were displaced from Paradise.

"Did PG&E save money in this process? Was this PG&E's lawyers? The hedge funds? This math was never right," Dunn continued. "This is egregious and there's absolutely no excuse for it. My biggest question now is, who is responsible for this? Who knew and let it happen anyway?"

When we asked PG&E to answer Dunn's question about why the stock funding came in at billions of dollars less than promised, the company declined to answer. It provided a statement.

"We continue to honor the victims of the Camp Fire and previous fires, and all that was lost, by continuing the important work to reduce wildfire and other risk across our energy systems. We funded the trust in accordance with our plan of reorganization," PG&E spokesperson Lynsey Paulo wrote.

Lily Jamali is a correspondent for KQED in San Francisco. She produced this investigation for the California Newsroom. Aaron Glantz, senior investigations editor for the newsroom edited this story together with managing editor Adriene Hill. It was copy edited by Jenny Pritchett of KQED.

The California Newsroom is a collaboration of NPR and 17 public radio stations across the state, from San Diego to the Oregon border.